All Categories

Featured

Table of Contents

- – Key Man Insurance Vs Life Insurance San Juan Ca...

- – Harmony SoCal Insurance Services

- – Key Man Disability Insurance San Juan Capistra...

- – Employee Benefits Broker Near Me San Juan Capi...

- – Employee Benefits Broker Near Me San Juan Cap...

- – Payroll Service For Small Business San Juan C...

- – Payroll Service For Small Business San Juan ...

- – Employee Benefits Services San Juan Capistra...

- – Payroll Services Near Me San Juan Capistrano...

- – Payroll Services San Juan Capistrano, CA

- – Key Man Disability Insurance San Juan Capist...

- – Employee Benefits Solutions San Juan Capistr...

- – Payroll Service Provider San Juan Capistrano...

- – Harmony SoCal Insurance Services

Key Man Insurance Vs Life Insurance San Juan Capistrano, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

In this blog site, we're mosting likely to discover the necessary variables to think about when choosing a pay-roll software application and checklist the 10 best pay-roll software program for small companies' needs. Employee Benefits Company San Juan Capistrano. Small businesses have particular payroll needs thanks to difficulties such as growing head count, restricted resources, and a lack of internal payroll experience

Detailing your demands up front will certainly conserve you time, help you prevent pricey blunders, and make it simpler to select the very best payroll service for your small company. Once you recognize your demands, it's time to research the pay-roll services available to you. The best payroll companies for little companies differ in regards to features, prices, and support, so it's worth casting a broad net.

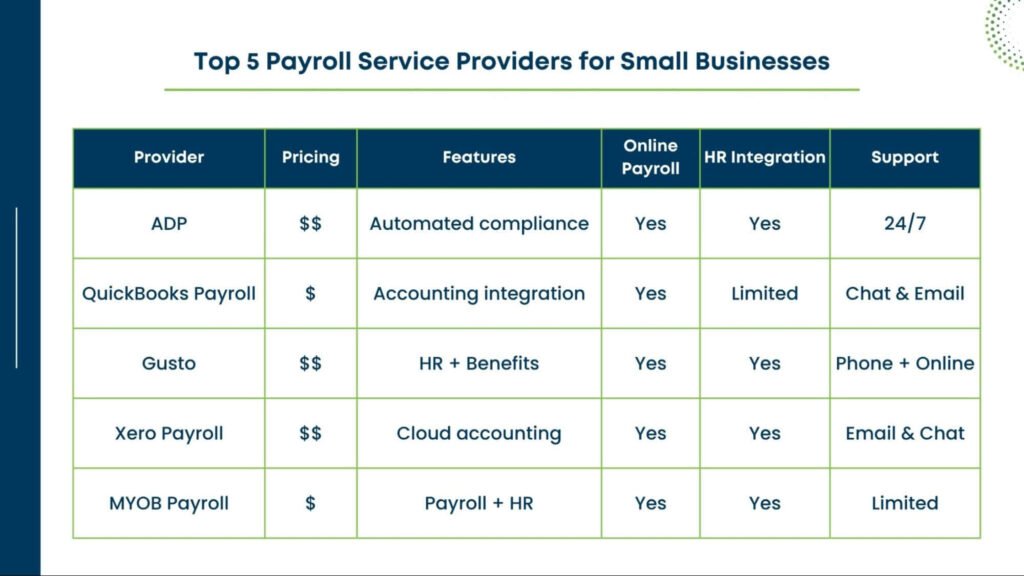

Rememberchoosing a pay-roll business isn't practically today's needs, however additionally concerning setting your company journey up for long-lasting success. Not all pay-roll attributes are created equivalent. A payroll option that works for one company may lack necessary abilities for another. That's why it's clever to contrast suppliers side-by-side and no in on the devices that matter the majority of.

Some pay-roll firms likewise supply discount rates for brand-new customers or packed payroll and human resources bundles. These can be a cost-effective means to start. Simply make certain you're not jeopardizing on conformity or long-lasting assistance for a short-term bargain. A trial duration is just one of the most effective ways to avoid expensive fines and verify you've chosen the best payroll company.

Key Man Disability Insurance San Juan Capistrano, CA

Payroll software might not be the most amazing subject, but it is essential for any business with workers. By choosing a pay-roll solution supplier that lines up with key service needs and objectives, you can transform away from tax files and spreadsheets and rather concentrate on growing your organization.

A good payroll service provides automatic tax computations for all degrees of tax obligations and remains updated with regulation modifications. It is helpful to opt for a payroll provider that likewise includes year-end tax filing solutions.

Small companies can then focus extra on development and much less on administrative tasks. Eric Simmons is a development advertising and marketing and demand generation experienced serving as the Senior Supervisor of Growth Marketing at Stax. Employee Benefits Company San Juan Capistrano. Throughout his tenure here, Eric has actually been important in propelling the business's impressive development, leveraging his knowledge to accomplish significant turning points over the past 6 years

Employee Benefits Broker Near Me San Juan Capistrano, CA

Prior to April 2, 2025, our tax obligation solution was not offered in all US states. The base price was greater in "tax obligation solution states," due to the fact that Wave automatically moved tax obligation settlements and filed the essential documentation with the state tax office and/or the IRS.Now, Wave provides our tax service in all 50 US states, meaning the rates is the same for all states.

All 3rd party trademarks, solution marks, trade names and logo designs referenced in this product are the property of their corresponding proprietors. Bank of America does not provide and is not liable for the products, solutions or performance of any third event. Not all materials on the Center for Business Empowerment will certainly be offered in Spanish.

Bank of America has not been associated with the preparation of the material provided at unaffiliated sites and does not ensure or think any kind of obligation for their material. When you go to these websites, you are agreeing to all of their regards to usage, including their privacy and security policies. Debt cards, credit report lines and finances undergo credit authorization and creditworthiness.

BofA Securities, Inc. is a registered futures commission seller with the CFTC and a member of the NFA.

Employee Benefits Broker Near Me San Juan Capistrano, CA

Little company payroll typically results in a huge frustration as managers and owners find out just how to do pay-roll by hand., your payroll calculations are automated.

As a small company owner, your time ought to be focused on growing your company and not on jobs that can be automated. A pay-roll solution provider like Square Pay-roll will save you money and time by helping you manage your payroll repayments, and taxes, optimize your staff schedule, and handle employee communications.

The ideal options equilibrium expense and capability. With Rise, the charges are extremely low and straightforward to recognize. For each and every specialist you have on the platform the rate is while transaction charges are just $2.5 per transaction or 3% for micropayments. Browsing the ins and outs of payroll tax obligations can be discouraging for little organization proprietors.

Professionals are automatically provided 1099s or W9/W8-Ben tax obligation forms during the onboarding process. Throughout the onboarding procedure all specialists on the Increase system are signed up compliantly with the following: Leveraging automated compliance with Increase not just conserves you time however likewise offers peace of mind, understanding that your company adheres to all governing demands.

Payroll Service For Small Business San Juan Capistrano, CA

The Surge system supplies 24/7 assistance for both specialists and services to make sure that all problems are settled as quickly as possible. This enables your group to run smoothly despite where they're located., a modular interoperability layer made for cross-chain smart agreement implementation, encountered considerable difficulties in handling payroll for its worldwide distributed team, that includes service providers from diverse nations.

As a small company owner, your time needs to be focused on expanding your company and out tasks that can be automated. A pay-roll company like Square Pay-roll will certainly conserve you money and time by helping you handle your payroll payments, and taxes, optimize your team schedule, and take care of worker interactions.

If you have hourly employees, you'll need to be able to track their arrival and departure each job day. Also if your entire staff member base makes up employed workers, your time and participation monitoring system will allow you to track made use of ill or getaway time, holidays, and a lot more. Your pay-roll solution might give these attributes in their software program or offer combinations with other software program remedies.

Payroll Service For Small Business San Juan Capistrano, CA

As talked about in the "advantages" section, one of the chief advantages of dealing with pay-roll solutions is having access to tax professionals and various other neighborhood professionals. If your payroll provider doesn't use those links, you will certainly miss out on this essential benefit. ConnectPay has an internal tax team and local partners in employees' compensation and accounting services.

Because of this, an additional necessary feature of any kind of payroll solution worth its salt is mindful, encouraging customer support. It's ConnectPay's plan that calls never most likely to voicemail throughout organization hours. You'll always be able to get a Connected Solution Representative on the phone to address your inquiry throughout the job day.

Employee Benefits Services San Juan Capistrano, CA

ConnectPay offers pay-roll solutions starting at the straightforward cost of $30 per pay-roll. We maintain points basic and easy to prepare forjust like they ought to be.

QuickBooks is an audit software with integrated payroll administration. It includes pay-roll handling, automated tax calculations, direct down payment, and compliance assistance. QuickBooks likewise supplies time tracking integrations yet does not incorporate with other audit systems. Phone-based client support is offered Monday through Friday, 6 AM to 6 PM PT, and Saturday, 6 AM to 3 PM PT.

A Qualified Client needs to be refining payroll with Paychex in order to receive 6 months of totally free pay-roll services, and any kind of unused month is not redeemable in U.S. currency or for any kind of other entity. The Promo only uses to pay-roll solutions, and Eligible Customers will certainly be solely in charge of all charges due for services apart from pay-roll solutions.

Wave pay-roll with tax obligation filing costs $40 plus $6 per energetic worker or independent service provider monthly. For companies outside of these states, you can pick the self-service option. In this instance, Wave calculates your pay-roll taxes, however you submit the files and pay the taxes on your own. This version costs $20 plus $6 per energetic employee or independent contractor monthly.

Payroll Services Near Me San Juan Capistrano, CA

You give them your details, and they manage the rest, or you can make use of the pay-roll start-up wizard. Paychex Flex works in all 50 states and uses 24/7 consumer solution, also with its base plan Paychex Flex Essentials. It instantly determines, data, and pays pay-roll taxes. Companies can do pay-roll jobs with voice assistant integrations with Siri and Google or obtain text alerts.

Its full-service pay-roll software program quickly manages pay-roll for 25 and sets you back $29 monthly plus $7 per worker. The payroll carrier likewise uses self-service and house payroll options.

A wise individual once claimed, "Outsource your payroll." We don't know that exactly that smart person was, but below at FA Bean Counters, our company believe that using a pay-roll service is an extremely sensible action. Pay-roll services are exceptionally popular with today's company owner, and completely factor. They make the payroll process reliable and easy.

Payroll Services San Juan Capistrano, CA

The best part regarding payroll solutions is that they take care of record filingon time! There are a great deal of pay-roll solution companies to choose from.

Swing pay-roll with tax declaring sets you back $40 plus $6 per active worker or independent specialist monthly. For business outside of these states, you can choose the self-service option. In this case, Wave calculates your payroll taxes, however you submit the records and pay the tax obligations yourself. This version sets you back $20 plus $6 per energetic staff member or independent professional monthly.

It instantly determines, data, and pays payroll tax obligations. Employers can do payroll tasks with voice aide assimilations with Siri and Google or get text alerts.

Its full-service pay-roll software application conveniently deals with pay-roll for 25 and costs $29 regular monthly plus $7 per worker. The pay-roll company likewise provides self-service and household pay-roll remedies.

Key Man Disability Insurance San Juan Capistrano, CA

Full-service payroll business submit taxes on your behalf. Pay-roll pricing might bundle tax obligation filing, year-end kinds, and worker repayments right into the base cost.

We don't know who precisely that sensible person was, yet here at FA Bean Counters, we believe that utilizing a pay-roll solution is an extremely smart move. Pay-roll solutions are extremely popular with today's company owners, and for good factor.

Employee Benefits Solutions San Juan Capistrano, CA

The ideal part about pay-roll services is that they deal with report filingon time! There are a great deal of pay-roll service suppliers to pick from. Listed below, we examine a couple of various choices so you can choose a service that meets your company's precise demands. Local Business Enjoyable, easy-to-use platform Might outgrow solutions as business size enhances $19/month + $6/employee (for very first six months) Small/MediumSized Organizations Functions seamlessly with QuickBooks Inconsistent Consumer Solution $13.50/ month +$6/employee (for initial 3 months) Little, Medium and Huge Sized Services Personalized service plans that change as business expands Higher Price Has to Ask For Quote Tailored to Various Sized Businesses Extensive Reporting and analytic tools More affordable plans do not consist of necessary services (ie.

Wave payroll with tax declaring costs $40 plus $6 per active worker or independent contractor monthly. For companies beyond these states, you can select the self-service option. In this case, Wave calculates your payroll taxes, however you file the papers and pay the taxes yourself. This variation sets you back $20 plus $6 per active employee or independent professional monthly.

It immediately computes, data, and pays payroll taxes. Companies can perform pay-roll tasks with voice assistant combinations with Siri and Google or obtain message notices.

Payroll Service Provider San Juan Capistrano, CA

Its full-service payroll software quickly manages pay-roll for 25 and sets you back $29 monthly plus $7 per staff member. The pay-roll provider likewise uses self-service and home pay-roll solutions.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Full-service payroll firms submit taxes on your part. Some pay-roll carriers supply personnel info systems with advantages management, employing, and performance monitoring devices. If you just employ freelancers and professionals, think about an affordable payroll service for 1099 employees. Pay-roll pricing may bundle tax obligation filing, year-end kinds, and worker repayments right into the base fee.

Key Man Insurance Vs Life Insurance San Juan Capistrano, CAEmployee Benefits Solutions San Juan Capistrano, CA

Payroll Services Near Me San Juan Capistrano, CA

Payroll Service For Small Businesses San Juan Capistrano, CA

Near Seo Firm San Juan Capistrano, CA

Local Seo For Small Business San Juan Capistrano, CA

Harmony SoCal Insurance Services

Table of Contents

- – Key Man Insurance Vs Life Insurance San Juan Ca...

- – Harmony SoCal Insurance Services

- – Key Man Disability Insurance San Juan Capistra...

- – Employee Benefits Broker Near Me San Juan Capi...

- – Employee Benefits Broker Near Me San Juan Cap...

- – Payroll Service For Small Business San Juan C...

- – Payroll Service For Small Business San Juan ...

- – Employee Benefits Services San Juan Capistra...

- – Payroll Services Near Me San Juan Capistrano...

- – Payroll Services San Juan Capistrano, CA

- – Key Man Disability Insurance San Juan Capist...

- – Employee Benefits Solutions San Juan Capistr...

- – Payroll Service Provider San Juan Capistrano...

- – Harmony SoCal Insurance Services

Latest Posts

Remodeling Bathroom Pleasanton

Bathroom Remodel Companies Near Me Concord

Clayton Plumbing Installation Contractor

More

Latest Posts

Remodeling Bathroom Pleasanton

Bathroom Remodel Companies Near Me Concord

Clayton Plumbing Installation Contractor