All Categories

Featured

Table of Contents

- – Payroll Service Provider Laguna Beach, CA

- – Harmony SoCal Insurance Services

- – Local Payroll Services Laguna Beach, CA

- – Employee Benefits Solutions Laguna Beach, CA

- – Local Payroll Services Laguna Beach, CA

- – Payroll Service Small Business Laguna Beach, CA

- – Payroll Services For Small Businesses Laguna...

- – Key Man Insurance Vs Life Insurance Laguna B...

- – Employee Benefits Consulting Laguna Beach, CA

- – Employee Benefits Brokerage Firms Laguna Bea...

- – Payroll Service For Small Businesses Laguna ...

- – Employee Benefits Outsourcing Companies Lagu...

- – Employee Benefits Consulting Laguna Beach, CA

- – Payroll Service For Small Business Laguna Be...

- – Harmony SoCal Insurance Services

Payroll Service Provider Laguna Beach, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Every service is distinct and your payroll system need to reflect that. Consider the list below variables when defining your business's pay-roll needs: Do you need pay-roll processing for five or 500 users?

Your staff may include hourly, employed and contract employees. Guarantee your company can handle this degree of intricacy. You might have staff in different states or perhaps abroad. If so, guarantee your supplier can manage out-of-state and global payments. If you offer medical insurance, retired life contributions or various other benefits, ensure your pay-roll service can fit your needs.

Ensure your service provider offers these combinations. Figure out a reasonable payroll solution spending plan that accommodates your team demands and the functions you need.

Local Payroll Services Laguna Beach, CA

Select a business that stays present on brand-new legislations that could go right into result. While this isn't a must-have credentials for a pay-roll solution, it can be a competitive advantage.

Secure payroll software application safeguards delicate details like employee addresses, birth dates, Social Protection numbers and bank information from unauthorized accessibility. Local business owner need to keep their revenues high and costs reduced, especially if they have a small company. Laguna Beach Best Payroll Services For Small Businesses. Payroll software supplies an affordable option to employing a certified public accountant. The negative aspects of pay-roll software application include these factors: Discovering to use pay-roll software and training others can be lengthy, especially if the software application has a complex interface or comprehensive features.

If your business has complex payroll schedules or stringent compliance needs, some software application might not totally meet your demands. Mark Fairlie added to this article. Source meetings were carried out for a previous variation of this write-up.

Many organizations begin off providing their own payroll.

Employee Benefits Solutions Laguna Beach, CA

They recognize the complexities included, including regulations, tax obligation prices, regulative changes, and the most recent payroll technology. Their experience can be particularly useful for services that operate in numerous territories, nations, or regions with differing tax obligation regulations and coverage needs. Pay-roll blunders can be pricey in terms of both finances and worker fulfillment.

It will certainly commonly really feel like they are an extension of your in-house team instead of dealing with a 3rd party. They are a lot more most likely to provide tailored and flexible services customized to your needs. Collaborating with an independent specialist may be much more economical for small companies with simple payroll demands.

An independent service provider may not have the ability to range solutions promptly as your organization grows. They may not have access to the very same level of innovation and software program as larger companies, which could affect effectiveness and security.

Local Payroll Services Laguna Beach, CA

The provider should remain upgraded on appropriate guidelines and guarantee that your pay-roll processes are legitimately audio. Scalability is an additional crucial aspect, especially if your organization plans to broaden in the close to future.

Every business is distinct and your pay-roll system should mirror that. Take into consideration the list below factors when defining your company's payroll needs: Do you need pay-roll handling for five or 500 users?

Ensure your carrier can manage this degree of intricacy. If so, ensure your supplier can take care of out-of-state and global repayments., retired life contributions or other benefits, ensure your pay-roll service can fit your requirements.

Payroll Service Small Business Laguna Beach, CA

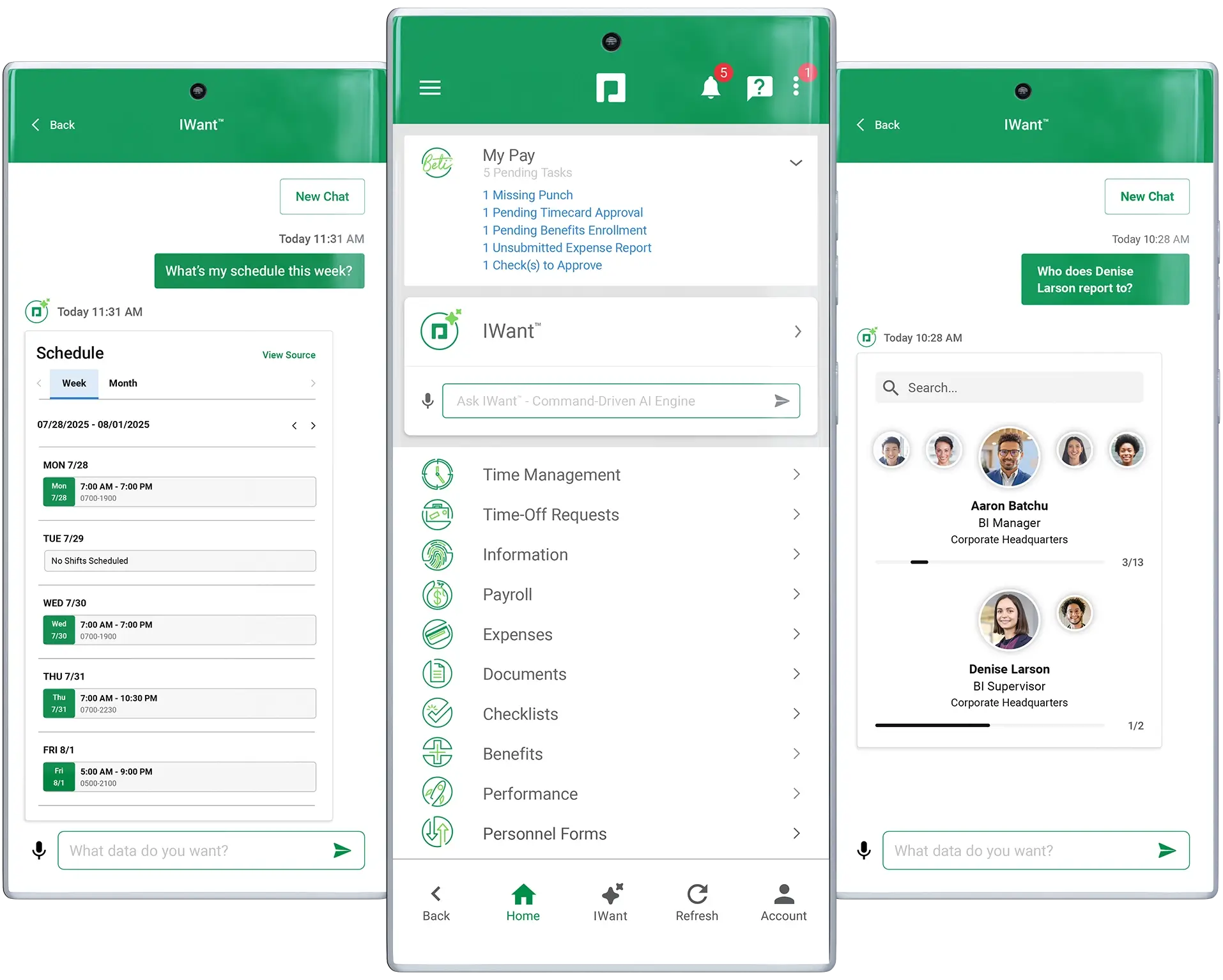

Guarantee your carrier supplies these integrations. Some payroll software application suppliers supply worker self-service alternatives that permit staff to gain access to pay-roll information, tax return and leave equilibriums. This function can reduce the workload for your interior HR division and local business owner. Determine an affordable payroll solution spending plan that fits your team demands and the features you require.

Choose a company that remains present on brand-new regulations that might go into impact. While this isn't an essential qualification for a payroll service, it can be an affordable advantage.

Secure pay-roll software protects delicate info like staff member addresses, birth dates, Social Safety and security numbers and bank details from unauthorized access. The downsides of pay-roll software program consist of these elements: Knowing to utilize payroll software and training others can be taxing, specifically if the software application has a complicated user interface or comprehensive functions.

Payroll Services For Small Businesses Laguna Beach, CA

If your company has complicated payroll schedules or rigorous compliance demands, some software may not completely fulfill your demands. Mark Fairlie added to this post. Source meetings were carried out for a previous version of this post.

They intend to feel taken treatment of, understood, and like a companion at the same time, not just an additional customer on a spread sheet. They want a payroll firm that would take a personalized technique that permits them to concentrate on the big image while we concentrate on the information that will obtain them there.

"Are You Searching For Worldwide Pay-roll Service Providers?" Let's consider the leading 15 global pay-roll service carriers. A worldwide payroll company resolves business's personnel requirements and advantages. Prior to choosing a pay-roll solution, take into consideration the variables that will help you pick the finest pay-roll solution for your organization.

Review the capacities you desire to gain or boost and how you will determine success. Take into consideration unifying your payroll procedures for all your worldwide staff into one system or enhancing your compliance monitoring capabilities to prevent lawful threats. Comparing payroll service carriers constantly without thinking about the results you intend to attain will certainly lose a great deal of important time.

Key Man Insurance Vs Life Insurance Laguna Beach, CA

We are a Global Employer of Record (EOR) and HR service. With business and neighborhood professionals in 214 nations and territories, we can hire, onboard, and pay your workers throughout the world. We aid you to include the greatest individuals to your team, despite where they are. Over the last 22 years, we have actually assisted innovative startups and Ton of money 500 companies in their international advancement.

Their spread personnel aids services throughout the globe. Company of Document (EOR) Contractor Administration Global Payroll Remote Moving Expansion Consulting Provider Rippling eliminates the friction of running a service.

For 70 years, they established the standard for figuring out the future of company options. ADP is one of the leading global payroll company and suppliers of cloud-based human funding management (HCM) systems that integrate pay-roll, HR, ability, time, tax obligation, and benefits, as well as a leader in company outsourcing and analytics.

Employee Benefits Consulting Laguna Beach, CA

Remofirst was produced in 2021, with a focus on remote operations from the begin. The goal is to make it less complicated for companies to set up remote teams and make the badge of international pay-roll solution companies.

All QuickBooks Online choices include an one-time assisted setup with a specialist and client assistance. They use the most effective payroll service remedies to customers. Audit Advanced Audit Digital bookkeeping Pay-roll Pay service providers Time tracking Payments and financial Venture Cloud Pay groups constantly attempt to develop an ambience in which everybody, no matter work or location, is respected, heard, motivated, and motivated to be their real selves at the workplace.

Employee Benefits Brokerage Firms Laguna Beach, CA

Employee Wellness Offering back International Pay-roll Global Repayments Worldwide Pay On-Demand The globe of global payroll solutions is promptly changing, driven by the growing demand for exact and certified payroll handling in an international setting. The top 15 globally payroll solution companies supply a variety of remedies to satisfy the certain needs of companies operating internationally.

ADP mobile options give employees accessibility to their pay-roll details and benefits, no matter where they are. Staff members can complete a selection of tasks, such as view their pay stubs, manage their time and presence, and enter time-off requests.

This process can be time consuming and mistake susceptible without the proper resources. That's why numerous companies turn to payroll provider for automated options and conformity knowledge. Companies usually aren't required to hold back taxes from repayments to independent specialists, which simplifies pay-roll handling. A pay-roll solution might still be of assistance.

Payroll Service For Small Businesses Laguna Beach, CA

Processing pay-roll in several states requires monitoring, understanding and abiding with the tax obligation legislations and policies in all states where you have employees. If you're doing pay-roll by hand now and strategy to switch over to a payroll service carrier, you should anticipate to reduce the time you commit to the procedure.

We additionally cater to various sectors, consisting of building, production, retail, healthcare and more. ADP's pay-roll solutions are automated, making it very easy for you to run payroll. Right here are some of the crucial actions to the process that we'll deal with for you behind the scenes: The total hours functioned by workers is increased by their pay rates.

Employee Benefits Outsourcing Companies Laguna Beach, CA

Swing payroll with tax obligation filing costs $40 plus $6 per active worker or independent professional monthly. This version sets you back $20 plus $6 per active staff member or independent contractor monthly.

It instantly computes, data, and pays pay-roll taxes. Companies can execute pay-roll jobs with voice aide combinations with Siri and Google or receive text notices.

ADP mobile services provide workers access to their payroll info and advantages, no issue where they are. Staff members can complete a selection of jobs, such as sight their pay stubs, manage their time and attendance, and go into time-off demands.

Employee Benefits Consulting Laguna Beach, CA

That's why lots of employers transform to pay-roll service providers for automated remedies and compliance expertise. A pay-roll solution might still be of support.

Handling pay-roll in numerous states requires tracking, understanding and abiding with the tax obligation legislations and policies in all states where you have workers. If you're doing pay-roll manually currently and plan to switch to a payroll service provider, you ought to expect to minimize the time you commit to the process.

We likewise cater to many sectors, consisting of construction, manufacturing, retail, health care and even more. ADP's pay-roll solutions are automated, making it very easy for you to run pay-roll. Below are some of the key actions to the procedure that we'll manage for you behind the scenes: The overall hours functioned by workers is increased by their pay prices.

Swing pay-roll with tax filing costs $40 plus $6 per energetic employee or independent specialist monthly. For firms outside of these states, you can select the self-service option. In this case, Wave calculates your payroll taxes, yet you submit the papers and pay the tax obligations yourself. This version costs $20 plus $6 per active staff member or independent professional monthly.

Payroll Service For Small Business Laguna Beach, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

You provide them your details, and they take care of the rest, or you can utilize the pay-roll start-up wizard. Paychex Flex operate in all 50 states and uses 24/7 client service, despite having its base strategy Paychex Flex Fundamentals. It immediately calculates, data, and pays pay-roll tax obligations. Companies can carry out payroll tasks with voice aide assimilations with Siri and Google or receive message notifications.

Payroll Services For Small Business Laguna Beach, CAKey Man Insurance Quote Laguna Beach, CA

Payroll Services Near Me Laguna Beach, CA

Employee Benefits Outsourcing Companies Laguna Beach, CA

Find Seo Services For Business Laguna Beach, CA

Finding A Good Local Seo Citations Laguna Beach, CA

Best Payroll Services For Small Businesses Laguna Beach, CA

Harmony SoCal Insurance Services

Table of Contents

- – Payroll Service Provider Laguna Beach, CA

- – Harmony SoCal Insurance Services

- – Local Payroll Services Laguna Beach, CA

- – Employee Benefits Solutions Laguna Beach, CA

- – Local Payroll Services Laguna Beach, CA

- – Payroll Service Small Business Laguna Beach, CA

- – Payroll Services For Small Businesses Laguna...

- – Key Man Insurance Vs Life Insurance Laguna B...

- – Employee Benefits Consulting Laguna Beach, CA

- – Employee Benefits Brokerage Firms Laguna Bea...

- – Payroll Service For Small Businesses Laguna ...

- – Employee Benefits Outsourcing Companies Lagu...

- – Employee Benefits Consulting Laguna Beach, CA

- – Payroll Service For Small Business Laguna Be...

- – Harmony SoCal Insurance Services

Latest Posts

Tankless Hot Water Heater Installers Near Me Solana Beach

Sabre Springs San Diego Water Heater Maintenance

Toilet Plumber Near Me Olivenhain

More

Latest Posts

Tankless Hot Water Heater Installers Near Me Solana Beach

Sabre Springs San Diego Water Heater Maintenance

Toilet Plumber Near Me Olivenhain