All Categories

Featured

Table of Contents

- – Health Insurance Plans For Students Yorba Linda...

- – Harmony SoCal Insurance Services

- – Vision Insurance For Seniors On Medicare Yorba...

- – Payroll Service Companies Yorba Linda, CA

- – Dental And Vision Insurance For Seniors Yorba...

- – Company Health Insurance Plans Yorba Linda, CA

- – Funeral Insurance For Seniors Yorba Linda, CA

- – Human Resources And Payroll Services Yorba L...

- – Best Funeral Insurance For Seniors Yorba Lin...

- – Employee Benefits Consulting Company Yorba L...

- – Best Payroll Service Yorba Linda, CA

- – Senior Vision Insurance Yorba Linda, CA

- – Harmony SoCal Insurance Services

Health Insurance Plans For Students Yorba Linda, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

The disadvantage is that costs will be greater than with term life, however the plus is that entire life insurance policy earns money value at a set, dealt with rate. One more advantage is that if you are brief on cash, you can take a funding out, yet know that a financing will lower the cash worth and death benefit of the policy as long as it continues to be superior.

While the hundreds of bucks that a funeral can expenses, feels like a great deal of money, it is rather little in the realm of life insurance policy advantages. That is why funeral policies are a very budget-friendly type of life insurance policy, also for older people and those with wellness problems! And although the stated value appear small, it is enough money to spend for interment and other expenses.

If you are an elderly person, or if you have parents who remain in their retirement years, you might have kept in mind the expenditure of funeral services today. The price of an extremely moderate funeral service standards about, 3000.00, and can set you back two times as much or a lot more! If you do not have that much cash money waiting around for an emergency situation like a funeral service, after that you may wish to start considering how you are going to pay for a funeral service expenses.

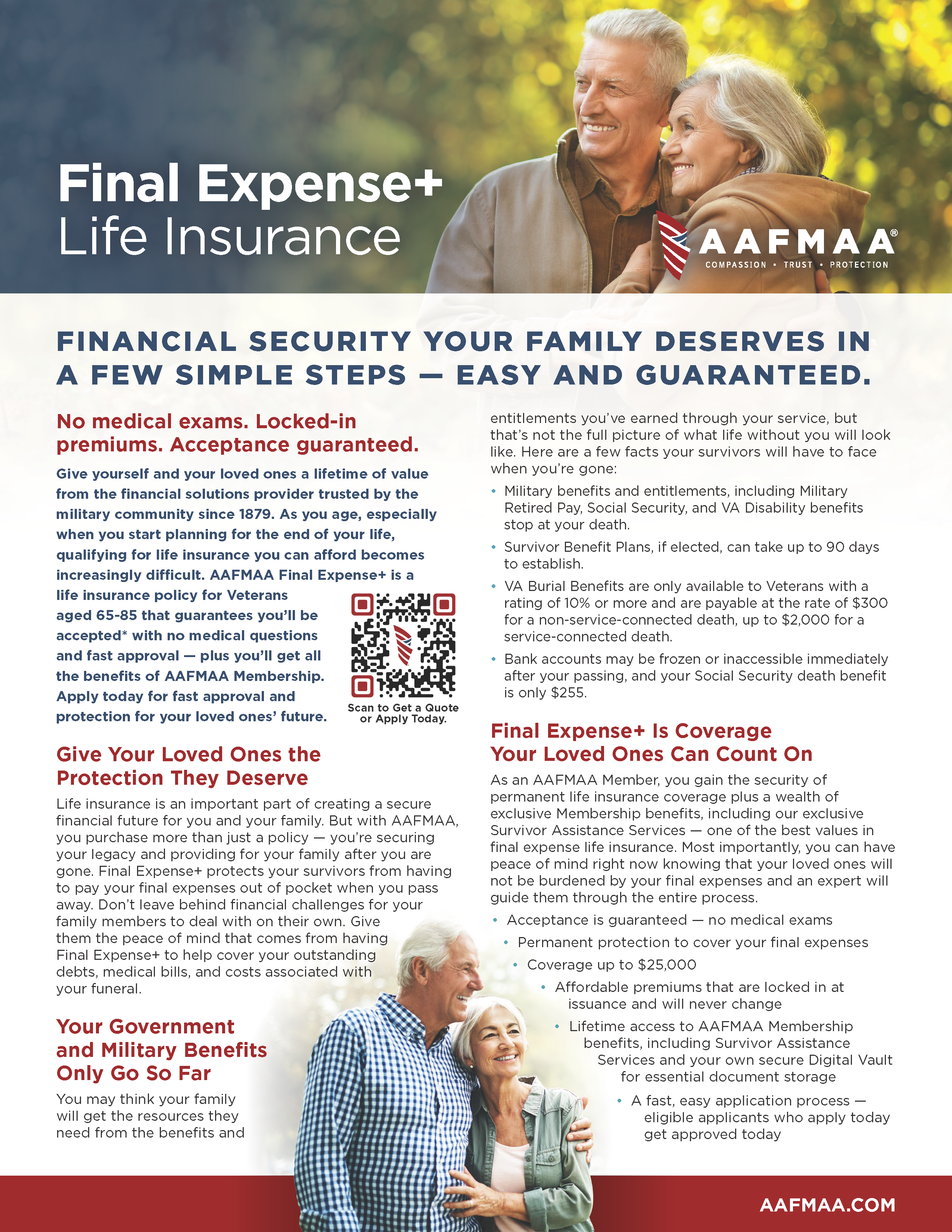

Last cost policies are little face value entire life policies. These can generally be bought for face values (survivor benefit) from a pair thousand dollars and up. Some might even rise greater however these can get very expensive for older individuals and those unhealthy. The rates are level for the rest of your life, and these whole life policies do not end after an established term.

Vision Insurance For Seniors On Medicare Yorba Linda, CA

If they must pass away, their costs will be reimbursed to the recipients with a stated rates of interest. For an individual who can not get other life insurance policy, these sort of policies are good options. If you are worried concerning spending for a funeral service, clearing up financial debts, and taking care of various other obligations that come with the moment when a loved one passes away, this can be an excellent option for you.

You can make the ideal selection for your household. Final Expense Life Insurance Policies Are an Inexpensive Way to Supply Safety And Security to Senior Citizens.

Last expenditure has higher age restrictions than the majority of. Most firms enable applicants in between ages 50 and 85. Nonetheless, the older you are when you apply, the higher your prices will certainly be. Last expenditure is simple to get. You will not need to set up a visit at a doctor's office like you would when applying for a various kind of life insurance policy.

Whether you address concerns relies on the sort of final expenditure plan you obtain - Human Resources And Payroll Services Yorba Linda. Final cost can come as simplified problem or guaranteed concern. There are noteworthy differences between both that make them the best option for some, however not others. Simplified problem: Needs answering questions as component of the application process Younger individuals without significant health issues will quickly be accepted and pay reduced rates Immediate protection, where the full survivor benefit will certainly be paid after the insurance holder makes the first settlement Ideal for more youthful, healthier applicants Ensured issue: No clinical underwriting Waiting duration of 2-3 years before the plan will certainly launch the survivor benefit If the insurance policy holder dies throughout the waiting period, just the premiums will be reimbursed Ideal for older individuals with wellness concerns Survivor benefit generally do not exceed $50,000, but that's even more than sufficient to cover funeral prices, which already, have an ordinary price of $9,420 according to the National Funeral Service Directors Association (NFDA)

Payroll Service Companies Yorba Linda, CA

Senior Citizen Life Solutions brings you plans that will certainly always be your own, and aid alleviate your loved ones' financial burdens. We will aid you locate the most effective policy for you both in insurance coverage needs and budget. Don't postpone. Call us today at (800) 548-3249.

Using detailed protection and individualized strategies to secure your enjoyed ones' tomorrow, today. Assurance for a joyous future Change your final expenditure insurance into a powerful financial possession, collecting money worth gradually to improve your future safety and security. With a tested track document, we've made the trust of thousands by providing trustworthy, customized elderly life insurance coverage remedies.

Devoted to safeguarding your individual info with the highest criteria of privacy security. Protect your enjoyed ones with cost effective, problem-free coverage Criterion Insurance coverage Spending plan Providers Limited Coverage Available Not Offered Partial Providing satisfaction via trusted assistance and care Fantastic representative friendly expert. "Extremely easy process for buying life insurance policy.

She was not just well-informed, but very simple to chat to. She had the ability to answer all my inquiries." Final Review. "I obtained handy info. I lowered my monthly settlement." Very expert experience. "Really professional experience, great item knowledge." Over and beyond. "Steven Camille went above and beyond to make sure that I was able to get the insurance coverage needed to aid with fulfilling the expense of both clinical and dental insurance." The rate and term was far better than I "The price and term was better than I anticipated.

Dental And Vision Insurance For Seniors Yorba Linda, CA

Unlike conventional entire life insurance policy, which supplies a larger survivor benefit, last cost insurance plan concentrate on covering instant expenses. Qualifying for this kind of insurance policy is simple, despite having pre-existing health and wellness problems. Since final cost life insurance policy is a kind of long-term life insurance policy, it continues to be effectively as long as you pay the costs.

Comply with these actions to locate a policy that fits your requirements and budget plan: Estimate funeral service, interment, and cremation prices, along with any impressive financial obligations. Collect quotes from different insurance firms to locate the most budget-friendly plan with ample insurance coverage.

Also if your wellness is aggravating or you're obtaining a little older, we can aid. Once you've locked in your strategy, your rates will certainly constantly remain the same, regardless of your age.

Rates for elders differ based on age, sex, desired insurance coverage amount, and whether you address health and wellness inquiries. Policies usually use in between $5,000 and $20,000 in benefits to individuals ages 50 to 85 (find out more concerning ). Some business provide their items to people who are over 85, and others have an optimum age limit for those to whom they provide plans.

Company Health Insurance Plans Yorba Linda, CA

You can obtain an idea of what you'll pay in costs for a common $5,000 or $10,000 plan listed below. The average cost of funeral insurance over 60 and under 65 varieties in between $18 to $88.

Females are cheaper to insure than males. The average price for elderly ladies varies from $22 to $77, while the price for senior men ranges from $29 to $93. $22 $27 $28 $33 $29 -$37 $35 $42 $41 $51 $55 $77 $56 $70 $68 $93 The average cost of final expense insurance coverage over 70 and under 75 ranges in between $28 to $116.

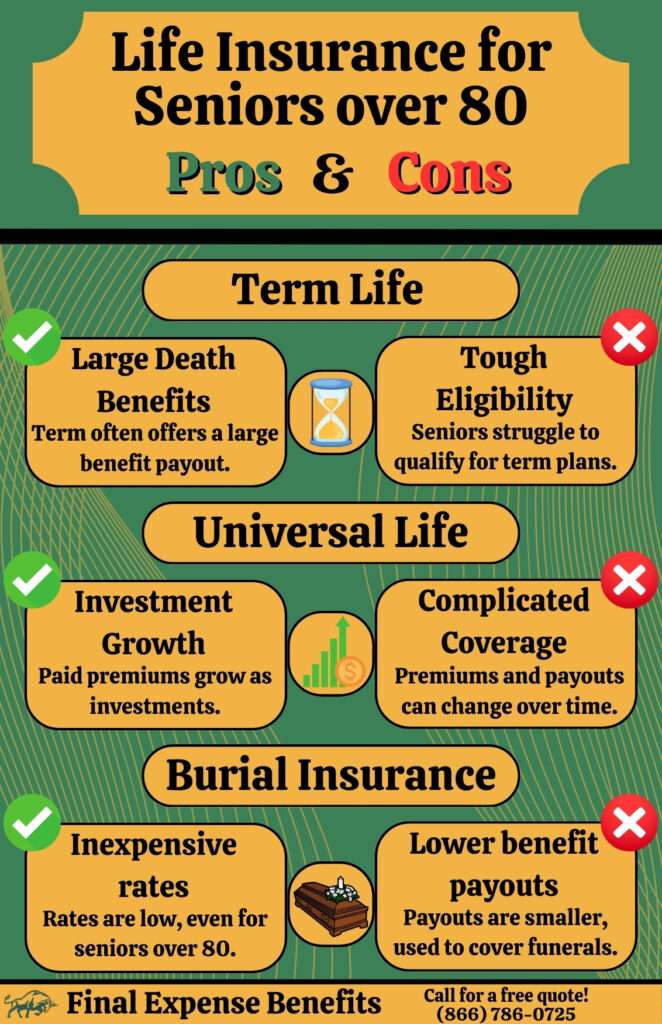

Each can be an important device for your loved ones to spend for your funeral and all of its associated expenses, however they are one-of-a-kind in just how they spread funds. Readily available as term or policies, beneficiaries of these strategies get funds upon the passing of their liked one when the life insurance policy case has been approved.

Funeral Insurance For Seniors Yorba Linda, CA

One of the biggest benefits of a pre-need plan is that it enables people the capacity to spend for solutions that might be less expensive currently than they will be in the future. There are benefits and disadvantages for both standard and pre-need coverage. Considering the benefits and drawbacks for every can assist elders choose which kind of strategy functions best for them.

For numerous seniors, a is adequate for their demands. While most go in increments of five, you can definitely buy if that quantity of senior life insurance policy satisfies your demands.

These elders can only rise to 15 years in term life insurance policy, and though it's less expensive, you can outlast it. When you get on set retired life earnings, every dollar counts, so they ought to benefit you. A final cost insurance plan is entire life insurance policy for elders. When your policy begins, your insurance coverage and prices are secured.

Human Resources And Payroll Services Yorba Linda, CA

You can access that money while you're still conscious utilize nonetheless you desire. No issue what sort of life insurance policy you buy, the younger you are, the cheaper the price. Mutual of Omaha and Prosperity Life Team provide some of the most affordable senior life insurance coverage prices by age. An additional name for last expense insurance is funeral insurance, and you can establish the correct amount based upon your insurance coverage needs.

Our representatives will certainly ask you a couple of concerns and not only assist you discover the appropriate buck amount, however the appropriate business for you. Contrast and buyfinal cost What's the ideal by health and wellness status? That depends on the business. Elders are no unfamiliar person to illness, and your health and wellness condition makes a difference when you obtain life insurance policy.

If you remain in inadequate health, you may not certify for a whole life insurance policy plan for senior citizens with the majority of these companies. Luckily, there are two companies that supply burial insurance with no wellness concerns in all. AIG and Great Western deal ensured problem last expense whole life insurance policy. You simply select a protection quantity, whether it's $16,000 or $19,000 or an additional figure, and you'll be accepted for a rate based on your age.

Protection amount picked will coincide for all covered children and may not surpass the face quantity of the base plan. Concern ages begin at thirty day with under 18 years old. Plan becomes convertible to a whole life policy in between the ages of 22 and 25. A handful of factors influence just how much final expense life insurance policy you really require.

Best Funeral Insurance For Seniors Yorba Linda, CA

Find out more concerning the different sorts of life insurance, just how to acquire life insurance coverage, and more.

, any ages, truly to get you covered with the life insurance you require. Still unsure if you need life insurance policy over 70 years of ages? We can assist you with that said, also. If you're a senior over 70, you could wonder if you also require life insurance policy (Human Resources And Payroll Services Yorba Linda). Not every elderly needs life insurance, however the majority of figure out that they require a minimum of some protection when they die.

Or, they can assist their moms and dads to get their very own life insurance policy seniors over 70.

Employee Benefits Consulting Company Yorba Linda, CA

With streamlined issue life insurance coverage, you have to answer a couple of health and wellness questions to get authorized, but there's no clinical examination., don't stress.

Our agents will ask you a couple of inquiries and not just assist you discover the best buck quantity, however the ideal business for you. Compare and buyfinal expense What's the best by wellness condition? That depends on the firm. Elders are familiar with wellness problems, and your health condition makes a distinction when you get life insurance policy.

Best Payroll Service Yorba Linda, CA

If you remain in poor health and wellness, you might not receive a whole life insurance coverage plan for seniors with most of these companies. Thankfully, there are two firms that offer burial insurance without any health inquiries at all. AIG and Great Western deal guaranteed issue last cost whole life insurance policy. You simply choose a coverage amount, whether it's $16,000 or $19,000 or one more number, and you'll be authorized for a rate based upon your age.

Insurance coverage quantity selected will coincide for all covered youngsters and may not surpass the face amount of the base plan. Concern ages begin at thirty day with under 18 years of ages. Policy becomes exchangeable to an entire life plan in between the ages of 22 and 25. A handful of factors influence just how much final expenditure life insurance policy you absolutely need.

Senior Vision Insurance Yorba Linda, CA

Find out more about the various types of life insurance, exactly how to purchase life insurance policy, and a lot more.

, all ages, actually to obtain you covered with the life insurance policy you need. Still not sure if you require life insurance policy over 70 years of ages? We can aid you keeping that, as well. If you're a senior over 70, you might wonder if you even require life insurance policy. Not every elderly needs life insurance, but many find out that they need at least some protection when they pass away.

Or, they can help their parents to obtain their own life insurance coverage senior citizens over 70.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

You get There are 2 options when you purchase funeral life insurance policy over 70: simplified problem or ensured issue. With simplified problem life insurance policy, you need to address a few health questions to obtain approved, however there's no medical examination. If your wellness isn't the most effective and you have pre-existing problems, do not worry.

Best Funeral Insurance For Seniors Yorba Linda, CABest Payroll Service Yorba Linda, CA

Best Payroll Service Yorba Linda, CA

Finding A Local Seo Services For Business Yorba Linda, CA

Find A Good Local Seo Services Pricing Yorba Linda, CA

Harmony SoCal Insurance Services

Table of Contents

- – Health Insurance Plans For Students Yorba Linda...

- – Harmony SoCal Insurance Services

- – Vision Insurance For Seniors On Medicare Yorba...

- – Payroll Service Companies Yorba Linda, CA

- – Dental And Vision Insurance For Seniors Yorba...

- – Company Health Insurance Plans Yorba Linda, CA

- – Funeral Insurance For Seniors Yorba Linda, CA

- – Human Resources And Payroll Services Yorba L...

- – Best Funeral Insurance For Seniors Yorba Lin...

- – Employee Benefits Consulting Company Yorba L...

- – Best Payroll Service Yorba Linda, CA

- – Senior Vision Insurance Yorba Linda, CA

- – Harmony SoCal Insurance Services

Latest Posts

Tierrasanta San Diego Electric Tankless Water Heater Installers

Gas Line Repair Rancho Penasquitos

Emergency Plumber Rancho Penasquitos

More

Latest Posts

Tierrasanta San Diego Electric Tankless Water Heater Installers

Gas Line Repair Rancho Penasquitos

Emergency Plumber Rancho Penasquitos