All Categories

Featured

Table of Contents

- – Company Health Insurance Plans Fullerton, CA

- – Harmony SoCal Insurance Services

- – Dental And Vision Insurance For Seniors Fuller...

- – Senior Insurance Services Fullerton, CA

- – Cheap Medicare Supplement Plans Fullerton, CA

- – Cheap Term Insurance For Seniors Fullerton, CA

- – Term Insurance For Senior Citizens Fullerton...

- – Senior Citizens Insurance Fullerton, CA

- – Best Dental Insurance For Seniors On Medicar...

- – Insurance Seniors Fullerton, CA

- – Senior Insurance Services Fullerton, CA

- – Best Private Health Insurance Plans Fullerto...

- – Employee Benefits Consulting Company Fullert...

- – Term Insurance For Senior Citizens Fullerton...

- – Cheap Term Insurance For Seniors Fullerton, CA

- – Harmony SoCal Insurance Services

Company Health Insurance Plans Fullerton, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

You can pre-pay for your funeral through a funeral chapel, yet if the funeral chapel goes out of service in the future, you'll shed that money. We generally do not suggest this choice. You can place cash into a depend on that your recipients would certainly use for your end-of-life expenses. If you have the financial savings, you can leave it behind to family participants and mark just how it must be made use of in your will.

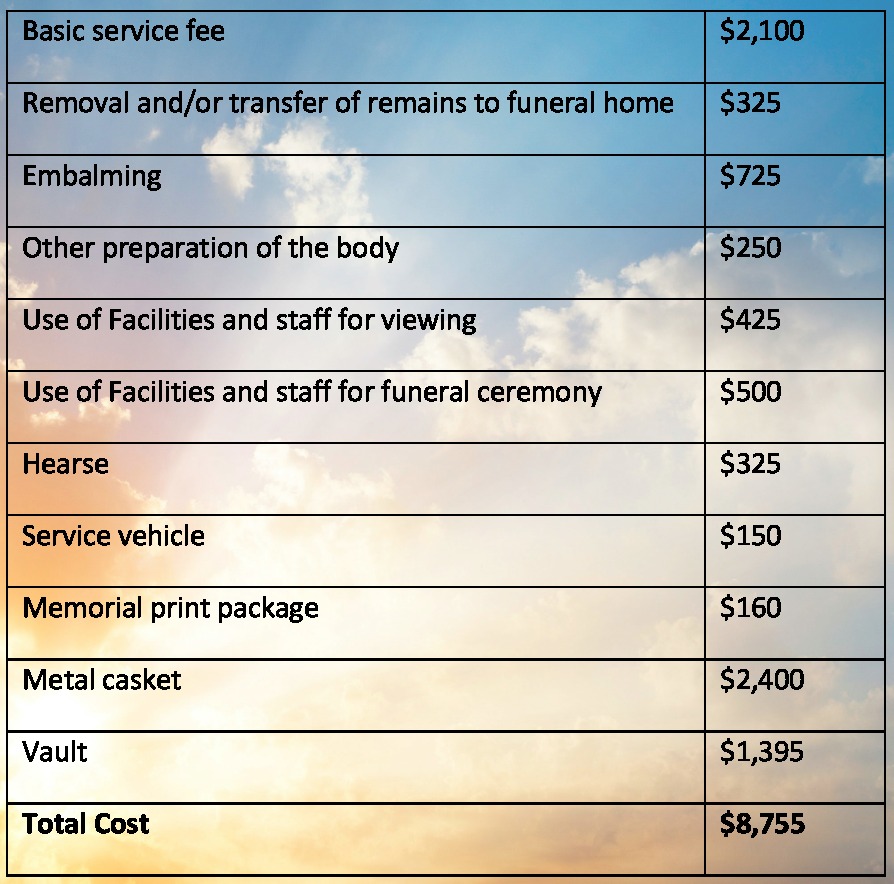

Final cost insurance policy is a kind of life insurance that helps senior citizens If you don't have a final expenditure life insurance policy plan in location for these bills, your loved ones will be accountable for them by default. Funeral prices are expensive, and there are probably a lot more expenses than you knew.

Dental And Vision Insurance For Seniors Fullerton, CA

Be advised, however, that a lot of business allow you acquire a policy with a really tiny advantage. A $3,000 policy is not virtually sufficient to cover the many standard of funerals.

State Ranch has the finest interment insurance if you want to function with an in-person representative. The policies typically have much less coverage than other types of life insurance, usually just paying out up to $25,000 when you pass away.

Instead, it's what's called an insurance policy broker. Ameritas John Hancock Legal & General America Mutual of Omaha Protective Life TruStage It could be a great concept to examine your rates for the same policy directly from each insurance business.

Yet when you die, your beneficiary will require to call the insurance policy company to sue, not Values. This can make it a bit more confusing than obtaining a policy straight from an insurance coverage business. Nonetheless, you might not have the ability to get that much protection, relying on your age and health and wellness.

Senior Insurance Services Fullerton, CA

In New York, both members and spouses have to be between 50 and 75. Funeral insurance coverage is a kind of life insurance policy you get to cover the price of your funeral and other end-of-life costs. Burial insurance is additionally called final expense insurance or funeral insurance coverage, and it's basically simply a little life insurance policy plan.

When you pass away, your beneficiary will certainly get the fatality benefit payment from your policy. They can utilize this money to pay for your end-of-life prices. Funeral service Coffin Embalming Burial plot Headstone Cremation Medical expenses Lawful costs Your recipient does not need to use it for your funeral service and other end-of-life expenses.

Cheap Medicare Supplement Plans Fullerton, CA

There are 2 types of funeral insurance that you can get: conventional funeral insurance and "pre-need" insurance policy. With a standard strategy, your beneficiary can make use of the money for anything - Term Insurance For Senior Citizens Fullerton. With a pre-need strategy, you choose your funeral plans in advance and the cash has actually to be utilized for that

Your beneficiary can after that use the cash for anything. While these policies are developed to cover the costs linked with your funeral or burial, your recipient has the freedom to utilize the money as required. Insurance coverage amounts are reduced contrasted to other kinds of life insurance coverage, usually only approximately about $25,000.

Pre-need burial insurance You'll pick a specific funeral home to collaborate with and prepare your funeral service beforehand. The funeral chapel will certainly let you know just how much whatever costs, and you'll pay for it in advance. This way, when you pass, your enjoyed ones do not need to fret concerning planning or spending for a funeral service.

If you buy a pre-need plan, it may be a good idea to likewise have a separate life insurance coverage strategy or money alloted specifically to assist your friends and family spend for unforeseen expenses. Funeral insurance coverage prices rely on your age, health and wellness and the company you select. Many insurance provider have a policy that they can not decrease to market you a plan due to the fact that of your health.

Cheap Term Insurance For Seniors Fullerton, CA

Final expenditure insurance comes with lower coverage amounts than regular term or irreversible life insurance coverage because it's created to just spend for your end-of-life expenses. While your beneficiary could have cash left over after paying for your funeral service, it isn't assured. But it depends on just how much coverage you already have and what you want your liked ones to be able to do with the money.

It's an excellent concept to plan in advance and get coverage when you're in health. In this way, you can obtain one plan with adequate insurance coverage for every little thing, rather than needing to get multiple plans. You can get funeral insurance policy protection as soon as possible, with no waiting period, yet it depends on the insurance provider's rules.

If you pass away in the very first two years of the plan, your beneficiary won't obtain the full fatality benefit. Rather, the insurer refunds what you have actually currently paid for the policy, typically with passion. Funeral insurance coverage, also called final cost insurance, does not offer you much protection. Typically, the plans just go up to around $25,000.

Term Insurance For Senior Citizens Fullerton, CA

And as we grow older, that planning starts to include preparing for end-of-life costs and funeral preparation. Even if senior citizens do not want to be associated with the planning of their memorial services, with the typical cost of a funeral varying in between $7,000 to $10,000, intending for the financial ramifications is a must.

You might additionally hear it referred to as last expenditures insurance policy or funeral insurance coverage depending upon the company. There are numerous various plans offered to fit those with differing wellness conditions and desired quantities. While it's great to have a lot choice, it can be frustrating to attempt and figure out which burial insurer and plan is best for your requirements.

Senior Citizens Insurance Fullerton, CA

We've included this terminology section to assist you comprehend precisely what each policy suggests as you're evaluating your alternatives. Burial insurance is a sort of whole life insurance policy, so you might see it referred to by various other names like last cost insurance coverage and funeral insurance policy. All of these policies offer the very same function.

You may still locate that the application procedure will certainly ask you concerning your elevation, weight, and standard health inquiries. Term Insurance For Senior Citizens Fullerton. These plans typically have greater premiums than other policies. The fatality advantage is the amount of cash the policy pays when you pass away. This is an amount that you choose, generally between $5,000 and $25,000.

Best Dental Insurance For Seniors On Medicare Fullerton, CA

While some do call for a set of questions, we favored those that ask fewer certifying inquiries. There are several funeral insurance coverage that permit the premium price to boost as you age. All of the policies consisted of in this overview have locked-in or ensured costs that will certainly never ever enhance as soon as you have actually been accepted.

With this feature, your costs repayments finish when you transform 95. The protection continues throughout the rest of your life, no matter of how lengthy you live. Since health care expenses have a tendency to climb as we age, this is an enticing function for conserving some money on premiums later in life.

AARP provides a 30-Day Assurance on the plan. While the Certificate of Insurance policy is provided as quickly as you're accepted, you'll have 30 days to assess the coverage.

The business has a reputation for being one of the extra innovative insurance coverage companies in the country. It has actually additionally been acknowledged for giving a superior consumer experience. Mutual of Omaha's Surefire Whole Life Insurance plan allows you to choose a benefit amount ranging from $2,000 to $25,000. The $2,000 alternative is rare, and makes the policy a superb choice if you're preparing for a tiny funeral service, thinking about cremation, or just don't wish to buy a bigger plan.

Insurance Seniors Fullerton, CA

With the ensured acceptance, every person is approved also if you have preexisting conditions that may invalidate you from other burial insurance coverage plans. Mutual of Omaha enables you to choose the advantage amount that ideal fits your requirements in quantities ranging in between $2,000 $25,000.

This policy does have actually a needed waiting duration of 2 years, so if you die as a result of natural causes throughout that time span, your beneficiary would only get a quantity equal to the premiums you have actually already paid, plus 10%. After the waiting duration ends, beneficiaries are entitled to the complete quantity of the policy.

Senior Insurance Services Fullerton, CA

It's worth keeping in mind, nevertheless, that AIG does not supply insurance coverage in the state of New York and charges a yearly $24 administrative cost on this plan. The firm focuses on offering people with monetary services that enable them to live long and satisfied lives at every phase of life. Because its creation in 1904, the company has always had a mission to make services offered to every person and now supplies a variety of retired life and insurance items to accommodate various stages of life and budgeting requirements.

Best Private Health Insurance Plans Fullerton, CA

18+ No Medical Examination Some Wellness Questions Approximately $50,000 None 121 This policy also stands apart for having no waiting period regardless of age. For those who purchase life insurance coverage earlier in life, waiting durations are little reason for issue. But also for any person who determines to buy a policy later in life or after being detected with a serious health problem, those multi-year waiting periods can injure your financial method and leave your loved ones with pricey expenses.

This policy is partially underwritten and requires you to respond to some questions regarding your health and wellness background, so you aren't guaranteed approval. The concerns are rather simple and no clinical exam is called for. The authorization process usually takes in between 2-5 days. While you can get this plan previously in life, the optimum fatality advantage quantity is influenced by your age.

As soon as you are accepted, premiums are assured and protection will never ever be modified or terminated as a result of your age or changes in your health situation. The policy develops a cash money worth that you can obtain against to cover emergency costs for you or your liked ones. The Immediate Remedy plan offers you with optional motorcyclists to accessibility funds for nursing treatment, as well as unintended survivor benefit, and kids's and grandchildren's advantages.

Employee Benefits Consulting Company Fullerton, CA

This is all done online and just takes a few mins to finish. Depending upon your solution to the concerns and your case history, you'll be matched with one of three variations of PlanRight policy. The plan you are accepted for will establish your advantage quantity, your costs, and whether or not there is a waiting period.

It's worth noting, nevertheless, that AIG does not give coverage in the state of New York and charges a yearly $24 administrative fee on this plan. The company focuses on providing individuals with financial services that enable them to live long and pleased lives at every stage of life. Because its development in 1904, the business has constantly had a goal to make services readily available to every person and currently supplies a variety of retired life and insurance items to accommodate various stages of life and budgeting demands.

Term Insurance For Senior Citizens Fullerton, CA

18+ No Medical Examination Some Wellness Questions As Much As $50,000 None 121 This policy likewise stands out for having no waiting duration no matter age. For those that buy life insurance coverage earlier in life, waiting durations are little cause for concern. For anybody who determines to acquire a policy later on in life or after being identified with a severe ailment, those multi-year waiting durations can hurt your economic technique and leave your loved ones with expensive bills.

This plan is partly underwritten and requires you to address some questions concerning your health history, so you aren't ensured authorization. While you can apply for this policy previously in life, the maximum fatality benefit quantity is affected by your age.

Cheap Term Insurance For Seniors Fullerton, CA

As soon as you are approved, premiums are ensured and protection will certainly never be modified or terminated because of your age or adjustments in your health circumstance. The plan constructs a money worth that you can obtain against to cover emergency situation expenses for you or your enjoyed ones. The Immediate Option plan supplies you with optional motorcyclists to accessibility funds for nursing care, along with unintentional fatality advantages, and youngsters's and grandchildren's benefits.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

This is all done online and just takes a few mins to complete. Depending upon your solution to the inquiries and your clinical background, you'll be matched with one of 3 variations of PlanRight policy. The plan you are authorized for will identify your advantage amount, your premiums, and whether there is a waiting duration.

Dental And Vision Insurance For Seniors Fullerton, CAHealth Insurance For Retired Fullerton, CA

Health Plan Insurance Fullerton, CA

Near My Location Seo Package Fullerton, CA

Find Seo Expert Fullerton, CA

Harmony SoCal Insurance Services

Table of Contents

- – Company Health Insurance Plans Fullerton, CA

- – Harmony SoCal Insurance Services

- – Dental And Vision Insurance For Seniors Fuller...

- – Senior Insurance Services Fullerton, CA

- – Cheap Medicare Supplement Plans Fullerton, CA

- – Cheap Term Insurance For Seniors Fullerton, CA

- – Term Insurance For Senior Citizens Fullerton...

- – Senior Citizens Insurance Fullerton, CA

- – Best Dental Insurance For Seniors On Medicar...

- – Insurance Seniors Fullerton, CA

- – Senior Insurance Services Fullerton, CA

- – Best Private Health Insurance Plans Fullerto...

- – Employee Benefits Consulting Company Fullert...

- – Term Insurance For Senior Citizens Fullerton...

- – Cheap Term Insurance For Seniors Fullerton, CA

- – Harmony SoCal Insurance Services

Latest Posts

Best Wedding Photographers In Ontario

Diamond Bar Travel Trailer Awning Replacement

Mercedes Sprinter Van Service Near Me La Habra

More

Latest Posts

Best Wedding Photographers In Ontario

Diamond Bar Travel Trailer Awning Replacement

Mercedes Sprinter Van Service Near Me La Habra