All Categories

Featured

Table of Contents

- – Employee Benefits Consulting Company Anaheim, CA

- – Harmony SoCal Insurance Services

- – Employee Benefits Service Anaheim, CA

- – Funeral Expense Insurance For Seniors Anaheim, CA

- – Term Insurance For Senior Citizens Anaheim, CA

- – Company Health Insurance Plans Anaheim, CA

- – Senior Citizens Insurance Anaheim, CA

- – Cheap Medicare Supplement Plans Anaheim, CA

- – Health Insurance Plans For Students Anaheim, CA

- – Term Insurance For Senior Citizens Anaheim, CA

- – Senior Insurance Services Anaheim, CA

- – Employee Benefits Consulting Company Anaheim...

- – Harmony SoCal Insurance Services

Employee Benefits Consulting Company Anaheim, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

The downside is that costs will certainly be more than with term life, however the plus is that entire life insurance gains cash money value at a set, dealt with rate. An additional advantage is that if you are short on cash money, you can take a financing out, yet know that a finance will lower the money worth and survivor benefit of the policy as long as it remains superior.

While the countless bucks that a funeral can prices, appears like a great deal of cash, it is instead small in the world of life insurance policy advantages. That is why funeral plans are a very affordable form of life insurance policy, even for older people and those with health conditions! And also though the face worths appear small, it suffices cash to pay for funeral and other expenses.

If you are a senior person, or if you have moms and dads that remain in their retirement years, you may have noted the expense of funeral services today. The cost of a really modest funeral service standards about, 3000.00, and can cost two times as much or much more! If you do not have that much money waiting around for an emergency like a funeral, after that you might desire to start considering how you are mosting likely to spend for a funeral service expenses.

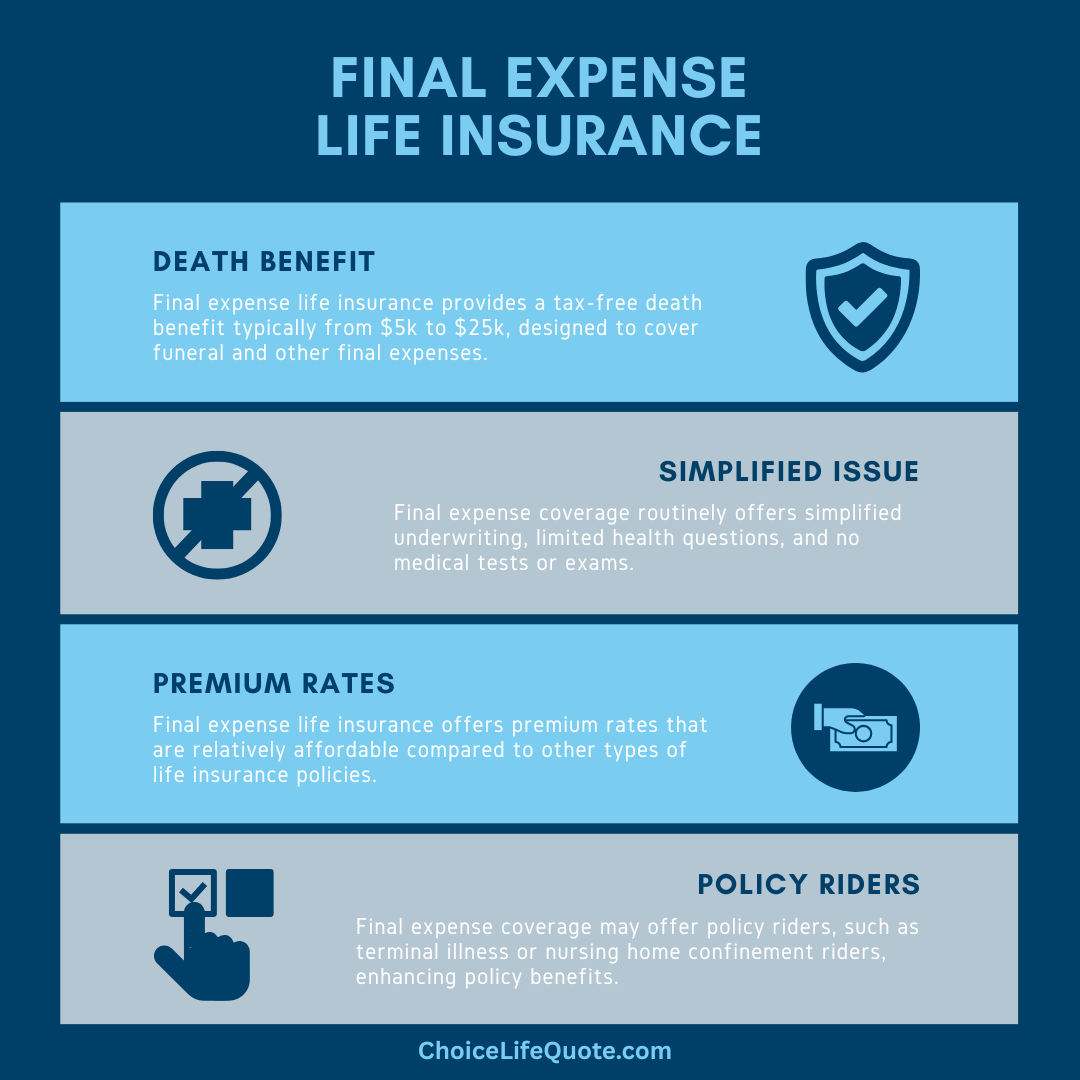

Last expenditure plans are tiny face value whole life policies. These can typically be acquired for face worths (survivor benefit) from a couple thousand dollars and up. Some may even rise greater however these can get extremely costly for older people and those in poor health and wellness. The rates are level for the remainder of your life, and these entire life policies do not expire after an established term.

Employee Benefits Service Anaheim, CA

If they ought to pass away, their costs will certainly be reimbursed to the recipients with a stated rates of interest. For a person that can not certify for other life insurance policy, these kind of policies are excellent alternatives. If you are concerned regarding spending for a funeral service, resolving financial obligations, and handling other obligations that feature the moment when a loved one dies, this can be a good choice for you.

You can make the ideal selection for your family members. Last Expense Life Insurance Coverage Policies Are a Cost Effective Way to Give Safety And Security to Elderly Citizens.

Final cost has greater age restrictions than a lot of. You won't have to schedule a consultation at a doctor's office like you would certainly when using for a different kind of life insurance policy.

Whether you answer questions relies on the type of final expense plan you get - Human Resources And Payroll Services Anaheim. Last expenditure can come as simplified issue or ensured problem. There are remarkable distinctions between the two that make them the ideal selection for some, but not others. Simplified concern: Needs addressing concerns as component of the application process Younger individuals without major health and wellness problems will quickly be approved and pay reduced prices Immediate protection, where the full survivor benefit will be paid after the policyholder makes the first repayment Suitable for more youthful, healthier applicants Guaranteed issue: No clinical underwriting Waiting period of 2-3 years prior to the policy will certainly launch the fatality benefit If the insurance policy holder dies during the waiting duration, only the costs will certainly be reimbursed Suitable for older people with health issues Survivor benefit typically don't go beyond $50,000, yet that's even more than sufficient to cover funeral expenses, which already, have a typical expense of $9,420 according to the National Funeral Service Supervisors Association (NFDA)

Funeral Expense Insurance For Seniors Anaheim, CA

Elder Life Providers brings you plans that will certainly always be yours, and aid minimize your loved ones' financial concerns. We will help you find the ideal plan for you both in protection demands and spending plan. Don't delay. Call us today at (800) 548-3249.

Providing extensive insurance coverage and individualized strategies to secure your liked ones' tomorrow, today. Comfort for a joyful future Change your last cost insurance coverage right into an effective monetary property, accumulating cash value gradually to enhance your future security. With a tested record, we have actually made the trust fund of thousands by supplying reliable, tailored elderly life insurance policy options.

Devoted to guarding your individual information with the highest criteria of privacy protection. Safeguard your loved ones with cost effective, hassle-free insurance coverage Criterion Insurance Budget plan Providers Limited Protection Available Not Offered Partial Giving assurance via relied on assistance and care Great representative pleasant expert. "Incredibly simple process for buying life insurance policy.

Final Evaluation. "I obtained valuable information. The cost and term was better than I "The rate and term was far better than I expected.

Term Insurance For Senior Citizens Anaheim, CA

Unlike conventional entire life insurance policy, which supplies a larger survivor benefit, last cost insurance plan concentrate on covering instant expenses. Receiving this type of insurance is very easy, despite pre-existing wellness problems. Because last expense life insurance policy is a type of irreversible life insurance policy, it remains effectively as long as you pay the costs.

Adhere to these actions to discover a plan that fits your needs and budget plan: Estimate funeral service, interment, and cremation costs, along with any superior financial debts. Collect quotes from different insurance providers to discover the most economical policy with sufficient insurance coverage.

As long as you're between the ages of 0-85, we have the perfect prepare for you. Even if your health and wellness is intensifying or you're getting a little older, we can help. There are no clinical examinations, and no one needs to come to your home to do any type of bloodwork. When you've secured your strategy, your prices will certainly constantly stay the exact same, despite your age.

Rates for elders differ based on age, sex, desired protection quantity, and whether you address wellness concerns. Policies normally use between $5,000 and $20,000 in advantages to individuals ages 50 to 85 (find out more concerning ). Some firms use their products to people that are over 85, and others have a maximum age limitation for those to whom they offer strategies.

Company Health Insurance Plans Anaheim, CA

You can obtain an idea of what you'll pay in costs for a typical $5,000 or $10,000 strategy below. The typical price of interment insurance coverage over 60 and under 65 varieties in between $18 to $88.

Females are less costly to guarantee than males. The average price for senior ladies varies from $22 to $77, while the price for elderly men ranges from $29 to $93. $22 $27 $28 $33 $29 -$37 $35 $42 $41 $51 $55 $77 $56 $70 $68 $93 The typical expense of final expense insurance over 70 and under 75 arrays in between $28 to $116.

Each can be a vital device for your loved ones to spend for your funeral service and all of its related costs, yet they are special in just how they spread funds. Offered as term or policies, beneficiaries of these plans obtain funds upon the death of their loved one once the life insurance policy claim has actually been approved.

Senior Citizens Insurance Anaheim, CA

Among the greatest upsides of a pre-need strategy is that it allows individuals the capability to spend for solutions that may be less costly now than they will certainly remain in the future. There are advantages and disadvantages for both typical and pre-need insurance coverage. Weighing the advantages and disadvantages for each can aid seniors make a decision which sort of strategy works best for them.

For several seniors, a is sufficient for their requirements. While most go in increments of five, you can certainly purchase if that quantity of senior life insurance fulfills your needs.

These senior citizens can only obtain up to 15 years in term life insurance policy, and though it's cheaper, you can outlast it. Once your policy begins, your coverage and prices are secured in.

Cheap Medicare Supplement Plans Anaheim, CA

You can access that cash while you're still to life to use however you desire., and you can determine the ideal quantity based on your insurance coverage needs.

Contrast and buyfinal expenditure What's the best by wellness status? Senior citizens are no stranger to health problems, and your health and wellness condition makes a distinction when you use for life insurance.

, you may not qualify for a whole life insurance coverage policy for elders with most of these companies.

Policy becomes exchangeable to an entire life policy in between the ages of 22 and 25. A handful of factors influence exactly how much last expense life insurance policy you truly require.

Health Insurance Plans For Students Anaheim, CA

Discover more about the different types of life insurance, how to acquire life insurance, and more.

, every ages, actually to get you covered with the life insurance policy you require. Still not certain if you need life insurance policy over 70 years of ages? We can help you with that said, as well. If you're a senior over 70, you may question if you even require life insurance policy (Human Resources And Payroll Services Anaheim). Not every elderly requirements life insurance, yet many find out that they require at the very least some coverage when they die.

They can have the policy and pay for it so that when their parents pass away, they can ensure their Mom or Daddy has the funeral service and funeral or cremation they want as a final send as they proceed to fulfill the Great Lord. Or, they can aid their parents to get their very own life insurance seniors over 70.

Term Insurance For Senior Citizens Anaheim, CA

You get There are two choices when you get funeral life insurance policy over 70: simplified concern or ensured concern. With simplified issue life insurance policy, you have to respond to a couple of health and wellness inquiries to obtain approved, yet there's no medical test. If your health and wellness isn't the very best and you have pre-existing problems, don't stress.

Contrast and buyfinal expense What's the best by health and wellness condition? Senior citizens are no complete stranger to health and wellness issues, and your wellness standing makes a distinction when you use for life insurance.

Senior Insurance Services Anaheim, CA

, you might not certify for an entire life insurance policy for senior citizens with most of these firms.

Plan ends up being exchangeable to an entire life plan between the ages of 22 and 25. A handful of variables affect exactly how much final expense life insurance coverage you really require.

Employee Benefits Consulting Company Anaheim, CA

Discover a lot more concerning the different types of life insurance policy, exactly how to purchase life insurance, and extra.

If you're a senior over 70, you could ask yourself if you even require life insurance policy. Not every senior needs life insurance coverage, however many figure out that they require at the very least some protection when they pass away.

Or, they can help their moms and dads to get their very own life insurance seniors over 70.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

You arrive are 2 options when you get funeral life insurance policy over 70: streamlined concern or guaranteed concern. With simplified problem life insurance policy, you need to respond to a couple of health concerns to get accepted, yet there's no medical examination. If your health isn't the ideal and you have pre-existing problems, do not fret.

Payroll Service Companies Anaheim, CABest Health Insurance Plans For Self Employed Anaheim, CA

Employee Benefits Consulting Company Anaheim, CA

Near My Location Seo Management Anaheim, CA

Find A Good Local Seo Companies Anaheim, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Consulting Company Anaheim, CA

- – Harmony SoCal Insurance Services

- – Employee Benefits Service Anaheim, CA

- – Funeral Expense Insurance For Seniors Anaheim, CA

- – Term Insurance For Senior Citizens Anaheim, CA

- – Company Health Insurance Plans Anaheim, CA

- – Senior Citizens Insurance Anaheim, CA

- – Cheap Medicare Supplement Plans Anaheim, CA

- – Health Insurance Plans For Students Anaheim, CA

- – Term Insurance For Senior Citizens Anaheim, CA

- – Senior Insurance Services Anaheim, CA

- – Employee Benefits Consulting Company Anaheim...

- – Harmony SoCal Insurance Services

Latest Posts

Best Wedding Photographers In Ontario

Diamond Bar Travel Trailer Awning Replacement

Mercedes Sprinter Van Service Near Me La Habra

More

Latest Posts

Best Wedding Photographers In Ontario

Diamond Bar Travel Trailer Awning Replacement

Mercedes Sprinter Van Service Near Me La Habra