All Categories

Featured

Table of Contents

- – Best Insurance Companies For Senior Citizens Fo...

- – Harmony SoCal Insurance Services

- – Insurance Companies For Seniors Fountain Valle...

- – Medical Insurance For Senior Fountain Valley, CA

- – Senior Insurance Companies Fountain Valley, CA

- – Senior Insurance Companies Fountain Valley, CA

- – Best Senior Medical Insurance Fountain Valle...

- – Medical Insurance For Senior Fountain Valley...

- – Medicare Supplement Insurance Near Me Founta...

- – Best Senior Health Insurance Fountain Valley...

- – Best Senior Health Insurance Fountain Valley...

- – Best Senior Medical Insurance Fountain Valle...

- – Insurance Companies For Seniors Fountain Val...

- – Insurance Companies For Seniors Fountain Val...

- – Best Insurance Companies For Seniors Fountai...

- – Harmony SoCal Insurance Services

Best Insurance Companies For Senior Citizens Fountain Valley, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

UnitedHealthcare is the best general business for short-term health insurance coverage plans. Temporary strategies almost constantly have worse protection than plans gotten with or your state marketplace.

This indicates you can customize your insurance coverage to your distinct requirements. Even though some strategies just cover in-network treatment, UHC's large network of doctors offers you much more freedom concerning where you get health treatment while still remaining in the network. Medicaid is one of the most inexpensive strategy for seniors and retirees who have reduced earnings.

Insurance Companies For Seniors Fountain Valley, CA

Even if you currently have Medicare, you can dual sign up in both Medicaid and Medicare to reduce your medical prices. Income limitations for Medicaid depend on where you live. In 40 states and Washington, D.C., you can get Medicaid if you make. The restrictions are greater in Alaska and Hawaii.

Senior citizens aged 65 and over who earn as well much to certify for Medicaid may still be able to qualify if they have high clinical costs. Medicare is the best wellness insurance coverage for retired people and elders.

Factors such as cost, protection, advantages and networks of medical professionals were used to compare firms. Other resources include: Medicare Benefit prices are just for strategies that consist of prescription drug benefits. The rate evaluation excludes employer-sponsored plans, Special Needs Plans, speed plans, sanctioned plans and Health Care Prepayment Program (HCPPs). Medigap prices are based upon data for all private firms, utilizing quotes for a 65-year-old women nonsmoker.

Discover vital health and wellness insurance policy for elderly citizens. As elderly residents navigate the complexities of health care, having detailed health insurance becomes increasingly essential. Health and wellness insurance offers financial defense and accessibility to crucial clinical services.

Medical Insurance For Senior Fountain Valley, CA

Without insurance policy, senior citizens might encounter significant monetary problems and limited access to needed health care - Best Supplemental Insurance For Seniors Fountain Valley. One of the vital benefits of medical insurance for senior citizens is the capacity to handle persistent conditions. According to the Centers for Medicare and Medicaid Solutions (CMS), in between 48% and 86% of individuals between the ages of 55 and 64 have a pre-existing problem, such as diabetes, heart illness, or cancer

Health insurance coverage offers peace of mind by shielding seniors from unanticipated clinical costs. With the increasing cost of healthcare, having insurance policy coverage aids mitigate the monetary concern related to hospital stays, surgeries, and other medical procedures. It enables seniors to concentrate on their wellness and health without bothering with inflated medical expenses.

Senior Insurance Companies Fountain Valley, CA

One of the essential provisions of the ACA is the prohibition on insurance provider refusing insurance coverage or billing greater premiums based on pre-existing conditions. This makes sure that people with pre-existing conditions, including seniors, have accessibility to inexpensive wellness insurance.Between 50 and 129 million non-elderly Americans have at least one pre-existing problem that would certainly endanger their access to healthcare and health insurance policy without the securities of the ACA.

Comprehending the significance of wellness insurance policy and the securities provided by the ACA is important for elders as they navigate their health care options. By exploring the available health insurance choices, including Medicare, Medicaid, and private insurance coverage plans, senior citizens can pick the coverage that finest meets their private demands and gives them with the comfort they deserve.

Understanding the various elements of Medicare can assist elders make educated choices regarding their healthcare needs. This section will certainly introduce Medicare and go over Medicare Prescription Medication Plans as well as added Medicare programs. Medicare is a Federal health and wellness insurance program made for people that are 65 years or older, certain individuals with specials needs, and those with end-stage renal condition (ESRD).

Senior Insurance Companies Fountain Valley, CA

With Initial Medicare, people spend for solutions as they receive them, normally paying an insurance deductible at the beginning of annually and 20% of the cost of Medicare-approved services, understood as coinsurance. For added prescription medication coverage, people can enroll in a different medication strategy, referred to as Component D. Considering that January 1, 2006, Medicare Prescription Medication Insurance coverage, also called Part D, has actually been offered to all people with Medicare, despite income, wellness standing, or prescription medication usage.

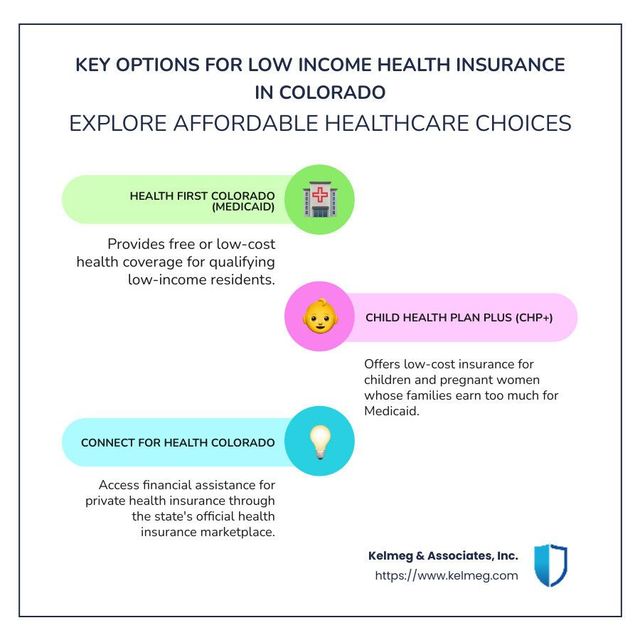

When it concerns medical insurance options for seniors, Medicaid and the Kid's Medical insurance Program (CHIP) play an important duty in providing budget friendly coverage. Allow's check out a review of each program. Medicaid is a joint federal and state program that provides complimentary or affordable wellness insurance coverage to various teams, consisting of low-income people, family members, kids, pregnant women, the senior, and individuals with disabilities.

Medicaid programs may differ by state, and qualification demands are figured out based on earnings and other factors. For certifying elders, Medicaid supplies detailed health care protection, including precautionary care, healthcare facility check outs, prescription medications, and lasting care solutions. It provides a lifeline for those who might not have the methods to manage private health and wellness insurance, aiding them keep their health and wellness and health.

In some states, CHIP also covers expectant women. This program ensures that youngsters have accessibility to vital medical care solutions, regardless of their household's revenue level. CHIP benefits vary by state however normally include detailed protection such as regular check-ups, booster shots, medical professional visits, and prescription medicines. It helps youngsters get the treatment they need to expand and thrive.

Best Senior Medical Insurance Fountain Valley, CA

This program boosts the lives of both the senior volunteers and the people they assist. Through the Senior Buddy Program, seniors have the opportunity to supply companionship, assistance, and assistance to various other senior citizens and adults with disabilities. This volunteer solution assists combat seclusion, provides significant social interaction, and promotes total health.

These plans incorporate Component A (healthcare facility insurance policy), Component B (clinical insurance), and typically Part D (prescription medication protection) into one extensive strategy. Medicare Benefit Strategies might provide added benefits not covered by Initial Medicare, such as dental, vision, and hearing services. On the various other hand, Medicare Supplement Insurance coverage policies, additionally called, assist cover costs not paid by Initial Medicare.

Choosing in between Medicare Advantage and Medicare Supplement Insurance coverage relies on private choices and medical care needs. Medicare Benefit Strategies might give extra advantages yet call for people to receive treatment from a network of providers. On the other hand, Medicare Supplement Insurance coverage enables individuals to pick any kind of doctor or health center that accepts Medicare.

The average price of medical insurance for a 60-year-old is around $994 each month, with the ordinary price for a 60-year-old couple being $1,987 per month. Medical insurance expenses for senior citizens can vary depending upon the type of plan selected, with Health care Organization (HMO) strategies normally costing less than Preferred Provider Organization (PPO) plans.

Medical Insurance For Senior Fountain Valley, CA

It's advisable to assess all available options and talk to a health care expert or insurance coverage expert to ensure comprehensive insurance coverage and comfort. When it pertains to health and wellness insurance coverage for seniors, understanding the expenses associated with insurance coverage is crucial. There are numerous factors to take into consideration, including costs and coverage rates, in addition to the various factors that can influence medical insurance premiums.

Numerous elements can influence the quantity individuals pay for medical insurance premiums. One such element is revenue. For Medicare beneficiaries, the majority of people will certainly pay the basic Component B premium amount, which was $174.70 in 2024. Those with a changed adjusted gross income above a particular threshold may likewise have to pay an added charge known as the Earnings Related Regular Monthly Modification Amount (IRMAA). For Medicare Component A, the basic costs in 2024 is $505 monthly.

It will be either $505 or $278, respectively. Other variables that can affect medical insurance premiums consist of age, place, cigarette usage, and the specific plan selected. It's important to thoroughly examine and contrast different insurance options to locate the plan that best satisfies individual requirements and budget. Understanding the expenses related to wellness insurance is important for senior residents as they navigate their insurance coverage choices.

Medicare Supplement Insurance Near Me Fountain Valley, CA

Disclaimer: General This details was prepared as a civil service of the State of Georgia to give basic details, not to recommend on any kind of particular legal trouble. It is not, and can not be interpreted to be, lawful suggestions. If you have concerns concerning any issue included on this web page, please get in touch with the relevant agency.

Reference plan papers for a listing of covered and non-covered preventative care services. 2$0 virtual care (no expense share) for eligible precautionary treatment and Devoted Digital Urgent Treatment for minor acute clinical conditions.

Best Senior Health Insurance Fountain Valley, CA

HSA plans and non-minor acute healthcare may use a copay, coinsurance or deductible. Cigna Healthcare offers access to Devoted Virtual Treatment through a nationwide telehealth provider, MDLIVE situated on myCigna, as component of your health insurance. Suppliers are exclusively accountable for any type of therapy provided to their patients. Online dermatological sees with MDLIVE are completed through asynchronous messaging.

6The downloading and use the myCigna Mobile App is subject to the terms and problems of the Application and the online shop from which it is downloaded. Requirement cellphone provider and data usage costs apply. 7 Rather, these programs offer a price cut on the price of certain items and solutions.

Some Healthy Benefits programs are not available in all states and programs may be ceased at any moment. Getting involved companies are entirely in charge of their products and services. Item availability might vary by place and strategy kind and goes through change. All medical insurance plans and wellness advantage strategies have exemptions and restrictions.

Best Senior Health Insurance Fountain Valley, CA

Young person can remain on their household's insurance policy plan up until age 26. The amount you pay for your health and wellness insurance policy might depend on where you live, your revenue, and the size of your family. Medical insurance expenses consist of a costs, which is what you spend for your insurance plan monthly.

Discover about these out-of-pocket expenses, including: There is a large range of Medical insurance Market prepares to pick from. They provide insurance coverage for not only healthcare however also dental and vision. Locate out what services all plans cover and what additional insurance coverage is available.To get going, go to to discover your state Medical insurance Marketplace.

Best Senior Medical Insurance Fountain Valley, CA

Many states allow you to apply both online and personally. You can enlist via or apply directly to your state's Medicaid firm or social services office. You can discover a listing of appropriate companies by state right here. Medicare is a government health insurance program provided to individuals who are 65 or older.

pays for other kinds of treatment, consisting of medical professional check outs, analysis medical tests, and clinical tools. Medicare Components A and B together are often referred to as "original Medicare" and are taken care of by the federal government. is also referred to as Medicare Advantage. It is a kind of Medicare plan you can purchase from private firms that contract with Medicare.

If you want more details, contact your state's social services workplace. If you are looking for an option to help manage your clinical costs, take into consideration healthcare financing with the CareCredit credit history card. The CareCredit card can assist you pay for the treatment you desire and need and make repayments simple to manage.

6The downloading and use of the myCigna Mobile App goes through the terms and problems of the App and the on the internet store from which it is downloaded. Criterion smart phone carrier and information use charges use. 7 Rather, these programs provide a discount rate on the cost of certain goods and solutions.

Insurance Companies For Seniors Fountain Valley, CA

Participating suppliers are only responsible for their items and solutions. All health insurance plans and health and wellness advantage plans have exclusions and constraints.

Young person can remain on their family's insurance strategy till age 26. The amount you pay for your health and wellness insurance may depend upon where you live, your income, and the dimension of your house. Wellness insurance policy costs consist of a premium, which is what you pay for your insurance coverage strategy each month.

Insurance Companies For Seniors Fountain Valley, CA

Learn more about these out-of-pocket prices, including: There is a variety of Medical insurance Marketplace intends to select from. They supply insurance coverage for not only treatment but likewise dental and vision. Figure out what solutions all strategies cover and what added protection is available.To begin, go to to find your state Medical insurance Market.

The majority of states permit you to use both on-line and personally. You can register with or apply straight to your state's Medicaid company or social solutions workplace. Best Supplemental Insurance For Seniors Fountain Valley. You can discover a checklist of proper firms by state here. Medicare is a government medical insurance program provided to individuals who are 65 or older.

Best Insurance Companies For Seniors Fountain Valley, CA

Medicare Parts A and B together are typically referred to as "initial Medicare" and are handled by the federal government. It is a kind of Medicare intend you can buy from private companies that contract with Medicare.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

If you want more info, call your state's social services workplace. If you are looking for an option to aid manage your clinical costs, consider healthcare financing with the CareCredit credit score card. The CareCredit card can assist you pay for the treatment you desire and require and make payments easy to take care of.

Affordable Home Insurance For Seniors Fountain Valley, CABest Insurance Companies For Senior Citizens Fountain Valley, CA

Best Eye Insurance For Seniors Fountain Valley, CA

Dental Insurance For Seniors Over 65 Fountain Valley, CA

In Seo Services For Small Business Fountain Valley, CA

Near Here Seo For Small Business Fountain Valley, CA

Harmony SoCal Insurance Services

Table of Contents

- – Best Insurance Companies For Senior Citizens Fo...

- – Harmony SoCal Insurance Services

- – Insurance Companies For Seniors Fountain Valle...

- – Medical Insurance For Senior Fountain Valley, CA

- – Senior Insurance Companies Fountain Valley, CA

- – Senior Insurance Companies Fountain Valley, CA

- – Best Senior Medical Insurance Fountain Valle...

- – Medical Insurance For Senior Fountain Valley...

- – Medicare Supplement Insurance Near Me Founta...

- – Best Senior Health Insurance Fountain Valley...

- – Best Senior Health Insurance Fountain Valley...

- – Best Senior Medical Insurance Fountain Valle...

- – Insurance Companies For Seniors Fountain Val...

- – Insurance Companies For Seniors Fountain Val...

- – Best Insurance Companies For Seniors Fountai...

- – Harmony SoCal Insurance Services

Latest Posts

Del Mar Heights Tankless Water Heater Installers Near Me

Plumbing Repair Near Me La Jolla

Rancho Bernardo San Diego Garbage Disposal Repair

More

Latest Posts

Del Mar Heights Tankless Water Heater Installers Near Me

Plumbing Repair Near Me La Jolla

Rancho Bernardo San Diego Garbage Disposal Repair